About 10 years ago, the Philadelphia 76ers began their own team building process to collect assets that could potentially mature into a championship team. While there is no goal of winning a ring, creating a high yield portfolio involves many of the same concepts.

We want to create a collection of around 15 investments (similar to players) that will become more valuable asssets as time passes - while also generating income (aka wins) each year. The beauty of this process is that your portfolio doesn’t have to suffer early like the 2013-15 76ers did to create a successful starting point. You just have to pick your initial investments that balance high dividend yields with lower risk to protect your starting capital.

Step 1 - Picking your winning team

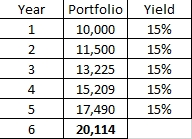

If you talk to traditional investors, a good dividend is usually between 2.5 and 3%. Staple value companies like Johnson & Johnson (2.75%), Coca-Cola (2.93%) and Home Depot (2.86%) fall into this group. If you are Warren Buffett and have billions to invest, these value stocks can offer an attractive location to store capital long term. Yet, if you are starting a portfolio with $10,000 (or event less) - then a 3% yield isn’t going to offer much for long term income growth. For that reason, we will be targeting a yearly dividend yield of around 15% for this portfolio. Take a look at the following graph to see why we chose this number:

After just 5 years of earning 15% yields and reinvesting those dividends, we will have doubled our money. Now that we have our goal, we need to begin the process of picking our investments. Here are the guidelines I use:

Target yields at 10% or higher: While there are some great investments that yield 4-5%, we can’t reach our goal with even a handful of sub 6% yield. For every 5% yield investment we choose, we need a corresponding 25% yield one to achieve our 15% goal.

Avoid individual companies whenever possible: Targeting high dividend yields often means you take on some risk. Putting a big chunk of our capital in one company can raise the risk profile significantly. A run of bad earnings or unforseen event can cut 20-50% of the stock’s value and put a dent into our capital goals. Sticking with investments that encompass many companies (Exchange-Traded Funds or ETFs) can spread that risk out while still generating higher yields.

Don’t stick to just one industry: Real Estate Investment Trusts (REITs) often pay higher dividends and can be very good investments. Yet, a portfolio full of REITs can get hammered if there is a financial crisis or dip in real estate prices. This is why good risk management involves selecting investments from multiple industries.

Use option premium volatility to generate income: One of the more common investment strategies for larger portfolios is a concept called Covered Calls. This involves selling out of the money stock options that should expire worthless to raise income to lower the cost of your shares. These can generate a nice bonus to your returns, but it comes with a few risks. First, you shares can be sold (or “called away”) if the stock does hit the price of your option. This means you take an immediate tax hit on the entire stock position. Second, if the share price drops a bunch, it can be hard to makeup for that lost capital selling options as the premiums aren’t worth as much. Wouldn’t it be great if you could get the income benefit of covered calls without risking your position being sold or one company’s stock price taking a hit?

Well, lucky for us there are investments that allow the best of both worlds called Covered Call ETFs. In these funds, managers handle the covered call process by selling options again indexes (not individual companies) and passing on the profit to us the investors in the form of monthly dividends. No big tax hit or capital risk, we just collect those monthly premiums. Needless to say, these covered call ETFs will be a staple of our portfolio!

Understanding the process for creating a high yield portfolio is a vital first step. We need to have rules to help us filter out investments that won’t help us achieve our goal of a risk-managed portfolio that yields 15% or more. In the next post, I will go through how we can offset even more risk by looking at position sizing and some guidelines on how to add to your positions over time.

I hope you enjoyed this first post and feel free to comment, email or hit me up on Twitter (@ArlesGreyDog) if you have questions.

Thanks,

Arlie

One final note - I am not a CFP or money manager, so understand that these are not official investment recommendations. Do not blindly use any of the information on my posts without doing your own due diligence (DD).